Shocks to the System: The Energy Transition and Its Implications for Korean Energy Companies in Valuations and Arbitrations

December 17, 2025

Valuation lies at the heart of sound decision making in business. In both contentious and non-contentious contexts, an understanding of an asset’s value (and the factors that affect that value) is central to analysis that is required to support good quality decision-making.

The power sector is frequently a source of disputes and arbitrations are frequently chosen as a resolution mechanism. For instance, according to Queen Mary’s 2022 Energy Arbitration Survey, arbitration was chosen by survey respondents as the most preferred method of dispute resolution across all categories of energy disputes. In addition, the International Centre for Settlement of Investment Disputes identifies the energy sector as the one responsible for the second-most number of cases in 2024. Reasons for this include:

- Size and scope. Power sector assets are frequently large and costly and may also have extended construction times. As such, the financial implications of events such as disruptions or delays can be significant.

- Technology. Power sector assets use a range of technologies, some of which are complex and which may not be well understood by all relevant parties when assets are built and when contracts are agreed. For new power generation technologies in particular, this may raise the possibility of disputes as the performance or costs of assets can be different from initial expectations.

- Policy and regulation. The financial performance associated with power sector assets are often closely linked to regulatory arrangements and government policy which can be complex, leading to challenges. Policy and regulation can also evolve over time, with significant impacts on existing assets.

The price of electricity—as a key driver of the revenues earned by electricity companies—is often a crucial input in valuations. As such, robust estimates of electricity prices are often needed in order to quantify claims for loss and damage in power sector disputes. This is important for Korea as it is one of the world’s largest electricity markets, ranking as the 8th largest producer of electricity in 2023. Korean companies are also frequently involved in energy infrastructure projects around the world, increasing the likelihood of involvement in disputes where the market price of electricity could be a key driver of revenues and potential damages.

In this article, we explore how the global transition to renewable energy is creating additional complexities in the sector, why this results in challenges for reaching accurate valuations in power sector arbitrations, and how more sophisticated analysis may be required to overcome such challenges.

The Global Energy Transition—A Shift from Coal to Renewables

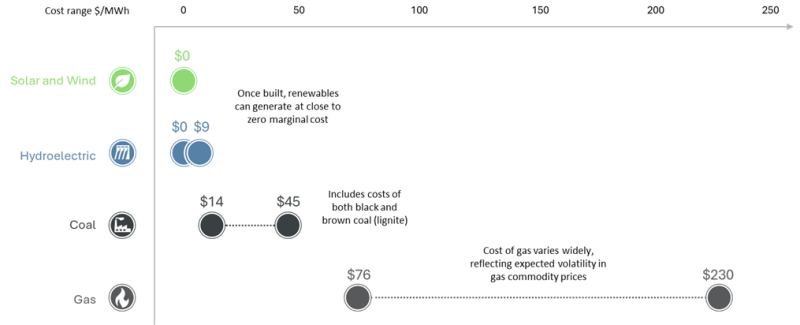

All over the world, countries are going through the energy transition, shifting from generating electricity through the burning of fossil fuels to using renewable energy sources. In countries that have progressed further in this transition (see examples in Fig 1 below), a key trend has been a reduction in the use of coal. This makes sense given wider objectives around emissions and air quality: coal is, by some margin, the most carbon-intensive fossil fuel, which presents the greatest risk to health. Countries have tended to phase out coal generation capacity and transition to less carbon-intensive forms of generation, including renewables such as solar, wind and hydroelectric power.

Fig 1. Major developed economies have reduced their reliance on coal generation, whilst increasing the share of generation from renewables.

Change in share of electricity generation from coal and renewables – comparison between Korea and selected OECD countries

Source: IEA (USA, UK, Australia, South Korea)

Note: some figures may appear not to sum due to rounding

Compared to some other developed economies, Korea is at a relatively early stage in this transition. Coal is still the single largest source of electricity generation in the country, accounting for 33% in 2024, with a lower share of renewable generation compared to other OECD countries. However, plans published by Korean authorities indicate an ambition to progress rapidly, targeting an increase in the share of renewable generation to 33% by 2038 and a reduction in coal usage to 10%.

The Impact on the Electricity Market—Greater Volatility and Unpredictability in Prices

The shift from coal to renewables described above means that many countries are now more reliant on renewables. This aligns with the wider objectives of the green energy transition, but there are implications for the market price of electricity:

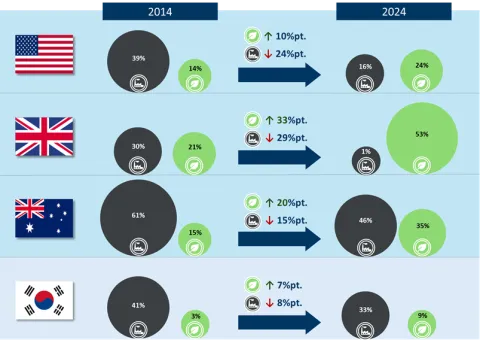

- Renewable generation is less costly. Renewable generators—in particular, solar and wind—are often willing to offer to produce electricity at low (or sometimes negative) prices, given that their fuel (sunlight and wind) is effectively free. This means that compared to fossil fuel generators, they have lower marginal costs of production: costs excluding those such as the cost of building generation assets. Furthermore, renewables are often subject to subsidy payments that are tied to the volume of electricity generated, further lowering the market price at which renewable generators are willing to produce electricity.

- Renewables are hard to control and predict. The output of renewable electricity generators can be difficult to control and predict as their source of energy is highly dependent on weather conditions that often do not align with demand: for example, electricity demand often peaks in the evenings when solar power is unable to produce electricity. In contrast, it is generally much easier to match the output of fossil fuel generators to changes in demand by simply increasing the amount of resources that are burned.

- Back-up sources of generation can be expensive. To cover for the unpredictable and variable nature of renewables generation, electricity systems have to rely on other sources of electricity to bridge the gap between renewables supply and what the system demands. This frequently comes from gas generation—traditionally significantly more expensive than coal and even more so with recent developments in gas commodities markets—although there is also increasing use of solutions such as imports from neighbouring electricity systems or battery storage.

Fig 2. Compared to coal, renewables are cheap whilst gas can often be significantly more expensive.

Illustrative costs of generating electricity with different sources of fuel

Source: Australian Energy Market Operator, modelling assumptions 2024

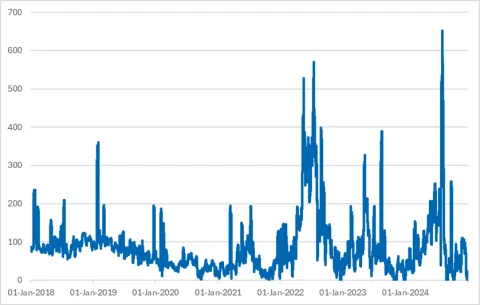

To summarise, compared to a world where coal was a major source of electricity generation, there is now more variation in the cost of generating electricity, whilst also more unpredictability in when different types of generation are used to produce the electricity that we consume. Both of these factors contribute to more volatility and unpredictability of prices in electricity markets that have proceeded further along the energy transition, although a multitude of other factors, such as the design of electricity markets, government policy and geopolitical factors, can also be relevant.

Fig 3. Electricity price volatility generally increases as a system progresses through its energy transition.

Illustrative example using electricity prices in South Australia since January 2018 (rolling average, one week window)

Source: AEMO

Relevance in Assessing Claims for Loss and Damage

In power market disputes, electricity prices can be an important input into the valuation analysis. In our experience, estimates of electricity prices become relevant when a valuer must:

- project an electricity company’s revenues into the future. We have seen this, for example, in investor-state arbitrations involving allegedly expropriated power plants; and/or

- consider the revenues that would have been earned in a hypothetical scenario in which the electricity price may have been higher or lower than it actually was over a given period. We have seen this, for example, in commercial arbitrations involving periods of disruption to the operations at power plants.

In electricity systems dominated by fossil fuels, it may be that prices are sufficiently stable and predictable that relatively simple analytical techniques—for example, extrapolation from historical average prices—are sufficient. For instance, we acted in an arbitration related to a power plant in India in which the experts on both sides were content to project the future electricity price by reference to historical data.

In more complex electricity systems which are expected to evolve more over time, however, we generally see more sophisticated analyses of electricity prices. In Europe, where use of renewables is relatively high, it is common for parties to engage expert witnesses to run electricity market simulations to estimate market prices. Consequently, the outcomes, in terms of the assessment of the value of losses and damages, might differ quite significantly depending on the techniques that opposing experts use.

These simulations are based on detailed and granular models of supply and demand in an electricity market on an hour-by-hour basis, taking account of the relevant costs of generating electricity from different sources and the price setting mechanisms in the market. These techniques are similar to those that electricity companies, regulatory authorities and investors use when they make decisions on operations, planning and investment in such markets.

Given Korea’s plans to accelerate through its energy transition, we may expect to see many of the same market dynamics discussed above—including increased price volatility and unpredictability—in the Korean electricity market. We therefore see a role for increasingly sophisticated analysis of electricity prices in power market disputes in Korea, as well as in disputes involving Korean power companies on their projects in overseas markets.

When adopting these more sophisticated techniques, it is important that the analysis be appropriate for the specific market to which it is applied. That is, one must avoid the pitfall of simply taking an approach used elsewhere and applying it without considering the nuances of the local market. To illustrate, in estimating power plant losses in Korea, we have seen experts from outside Korea run sophisticated market simulations but neglect to account for aspects of the regulatory structures in the Korean electricity market that govern the profits of electricity companies. In such cases, despite the market simulation being sophisticated, the conclusions regarding the impacts on companies—and the analysis on damages—may ultimately be undermined.

Concluding Remarks

The transition to renewable energy is happening worldwide and will have wide-ranging impacts in electricity markets across the world. The impacts on markets and prices can be volatile and unpredictable and become more pronounced as the pace of the energy transition accelerates across Asia. In this context, the potential for disputes is likely to grow as investment into the sector increases, but more sophisticated techniques can help bring robust analysis to support companies in both contentious and non-contentious contexts.

We therefore foresee that a combination of international and local power market expertise will be particularly valuable for Korean companies in power market disputes, and thus arbitrations, both in Korea and in their ventures abroad, providing the benefits of analytical expertise and a true understanding of the relevant market.

You may also like